Building PowerCred with Co-founder & Chief Technology Officer, Shrinivas Deshmukh

Going back to the day when PowerCred first began, the co-founder and CTO shared his side of the story of the Building PowerCred

Building PowerCred with Vasudha Sinha, Founding team- Marketing

As a part of our ‘Building PowerCred’ series, we got Vasudha Sinha, a founding member of the marketing team at PowerCred, to share the story of her journey so far and to tell us about how she strategises the marketing efforts for a dynamic product and high-growth start-up.

Unlock and Sustain Growth for your Lending Business with Alternate Data

Grow you lending business with alternate data accessed using PowerCred’s universal API suite.

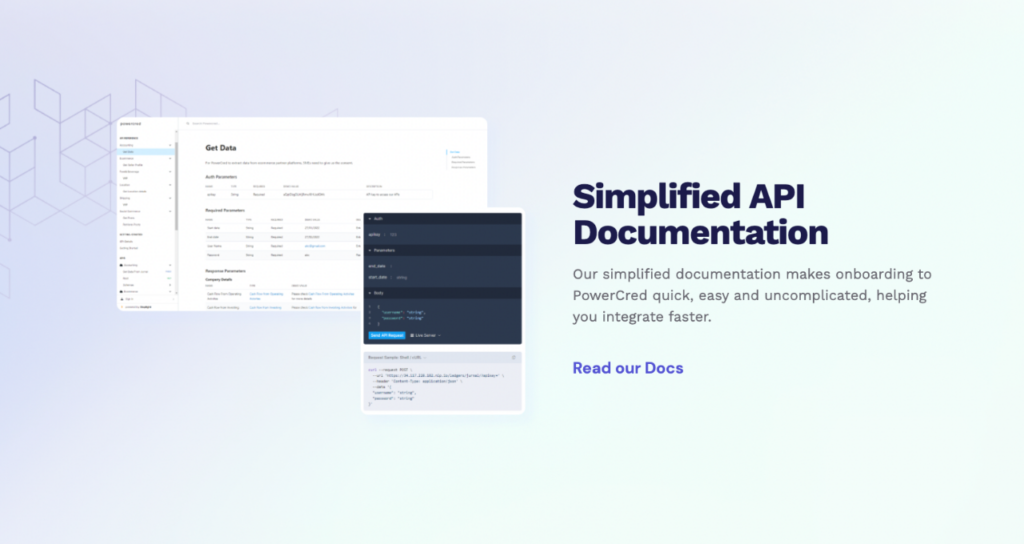

Building a Seamless Integration Experience for Financial Service Providers

Our product offers a seamless integration for small business data to financial service providers, allowing them to optimise the way they leverage customer data and help them achieve their business goals and serve small businesses better.

How quick and simple is it to integrate with PowerCred?

PowerCred offers an API integration for small business data that is quick and simple to integrate with.

Understanding PowerCred’s Accounting Coverage

PowerCred offers accounting data with the right data partnerships with platforms such as Accurate, Jurnal, Xero and QuickBooks which are commonly used by small businesses to manage their accounts.

E-wallet Data for Smarter Lending & Loan Collections

The growing adoption of e-wallets and the data being generated with their use has made it increasingly crucial for financial service providers to tap into this data to gain insights for making smarter lending decisions.

SME Digitisation & Improving Access to Credit for Small Businesses

Read insights on SME digitisation and improving access to credit for SMEs in Southeast Asia from our first episode of PowerTalks with Aditya Chintawar, the Chief Product Officer at Koinworks, a leading fintech platform in Indonesia.

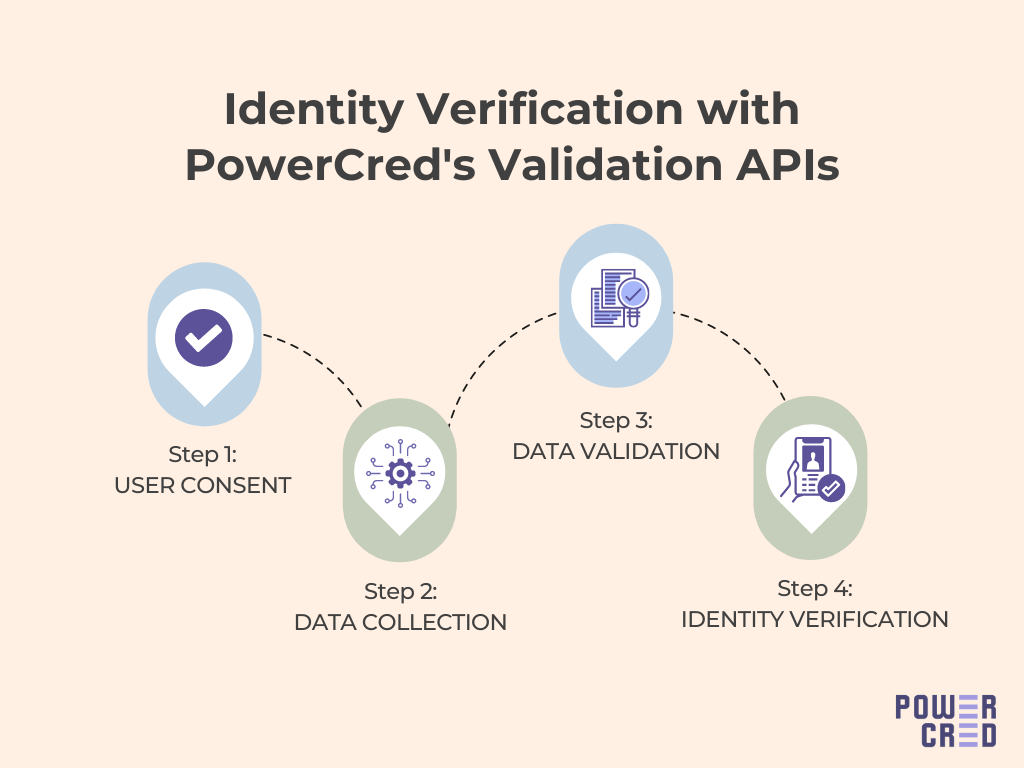

How does Alternative Data help with Identity Verification in the Digital Age?

Leveraging alternate data for identity verification of a small business customer without the hassle of collecting a massive amount of traditional data. PowerCred’s Validation APIs can help financial service providers verify the identity of their small business customers by validating consented data from e-commerce and telco sources, in a quick and secure manner.

How can Financial Service Providers enhance the Lending Experience for SMEs?

Financial service providers can enhance the lending experience for SMEs with insights from their alternate data.