SMEs in Southeast Asia are the backbone of business in the region and makeup about 97% of all businesses, employ 69% of the workforce and bring 40% of GDP value across the region. Of the six ASEAN countries, Indonesia has 62 million SMEs which have the largest GDP contribution at 61% yet have limited access to financial services. This has made the financial inclusion of such small businesses a top priority for the Government of Indonesia. By 2024, their goal is to increase financial inclusion from the current 76% to 90%.

In order to support this goal of financial inclusion of small businesses in Indonesia, banks and financial service providers need to expand their reach and build more relevant products for small businesses. The first step in onboarding new customers is identity verification. This step ensures protection against identity fraud which is the most common fraud today. However, often the lack of sufficient identity proof or documentation and financial data does not allow financial service providers to successfully verify the identity of small business customers and prevents them from serving these businesses.

To address this issue, financial service providers need to explore other sources of information that can help them verify the identity of their small business customers. With growing digitalisation and the use of digital technologies, small businesses generate a digital footprint and digital identity information that can be verified by leveraging and validating data from multiple sources.

Identity verification with Alternative data

Leveraging alternate data such as e-commerce data, telco data and bank connect data can help verify the identity of a small business customer without the hassle of collecting a massive amount of traditional data. Alternate data APIs such as PowerCred’s Validation APIs can help financial service providers verify the identity of their small business customers by validating consented data from e-commerce and telco sources, in a quick and secure manner.

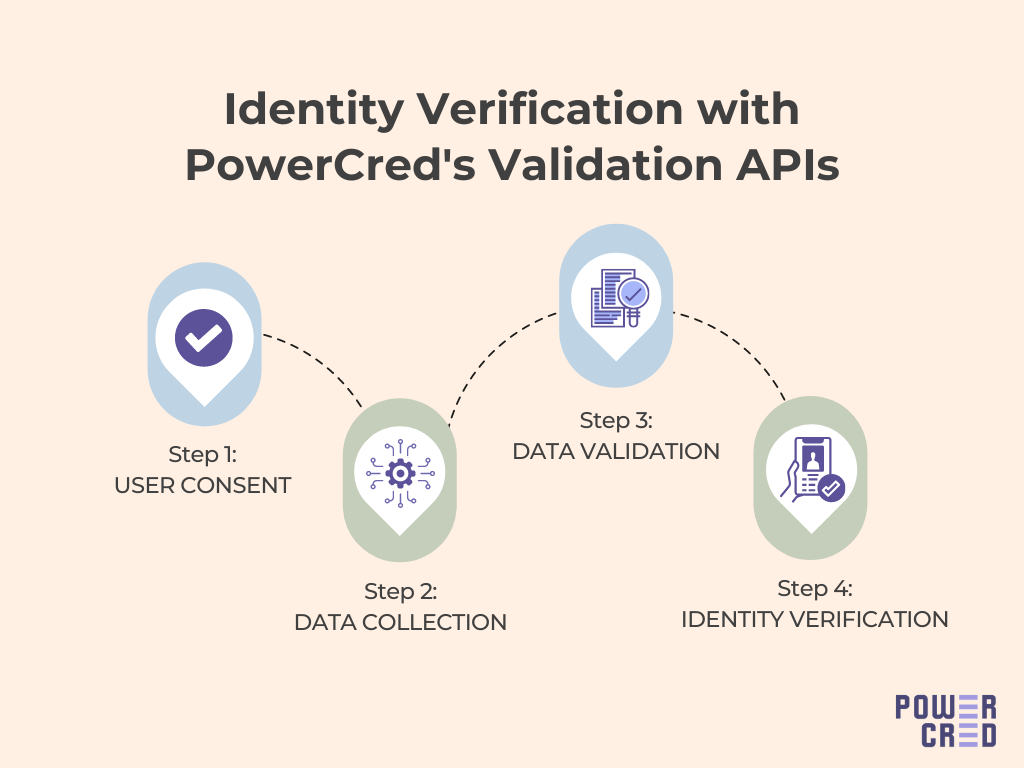

At PowerCred, our Validation APIs follow a 4-step process of identity verification using alternative data:

Consent– The small business customer selects the data it would like to share with the financial service provider and shares the credentials and consent to enable access to the same.

Data collection– PowerCred securely accesses the consented data from multiple sources such as the small business customer’s e-commerce data, telco data and bank connect data.

Data validation– Our validation APIs cross-check and verify the data accessed from multiple sources to verify the identity information of the small business customer.

Identity verification– Once the selected data and identity information is validated by our Validation APIs, the identity of the small business customer is verified or data discrepancies, if any, are flagged alerting the financial service provider.

A win-win situation

Identity verification using alternative data creates a win-win situation for both the financial service providers and their small business customers. Here’s how:

Quick process- Identity verification with alternative data involves leveraging available information, without the tedious and time-consuming process of collecting massive amounts of traditional identity information. The use of APIs in the process further reduces the manual effort involved, adding more speed to the process.

Uses readily available data- The process uses readily available, real-time alternative data of small business customers making it a convenient process for the financial service providers as well as their customers who need not produce and submit any physical documentation.

Consented data- Small business customers do not lose control over their data being shared for the purpose of identity verification and can choose to share consent only for their choice of data.

Safe and secure- The entire validation process is carried out digitally in a safe and secure manner, respecting the data privacy and security of the small business customers’ information.

Minimised fraud- Identity verification with alternate data involves validating authenticated data from multiple data sets, minimising the possibility of fraud and associated losses.

Promotes inclusion- Such identity verification can help onboard even the ‘thin file’ small businesses and enable them to access financial services, promoting their growth and financial inclusion. Being able to onboard this segment can also mean more business and an expanded customer base for financial service providers.

Conclusion

Identity verification is essential for every transaction and industry given that identity fraud is the most common fraud today. Thus, it is important for financial service providers to safeguard themselves against identity fraud and take steps to verify identity in new ways, if not traditional. Verification of identity with alternate data sources can help financial service providers verify the identity of their small business customers that lack the ability to produce any formal identity information. Identity verification in a quick and secure manner with alternative data APIs can help financial service providers offer a better customer experience, support growth and promote the financial inclusion of small businesses.

In times when customer acquisition is difficult and financial service providers are facing tough competition, identity verification using alternate data sources may present an opportunity to grow business with an expanded customer base.

PowerCred is committed to helping financial institutions unlock the power of small business alternate data to gain actionable insights for making smarter business decisions. If you are a financial service provider and would like to learn more about our validation APIs, get in touch with us or book a demo with our team.