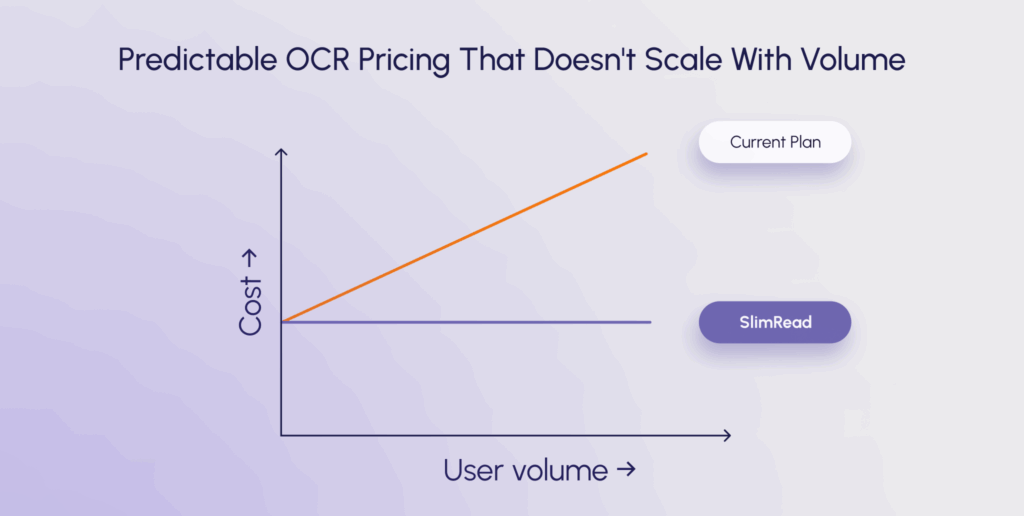

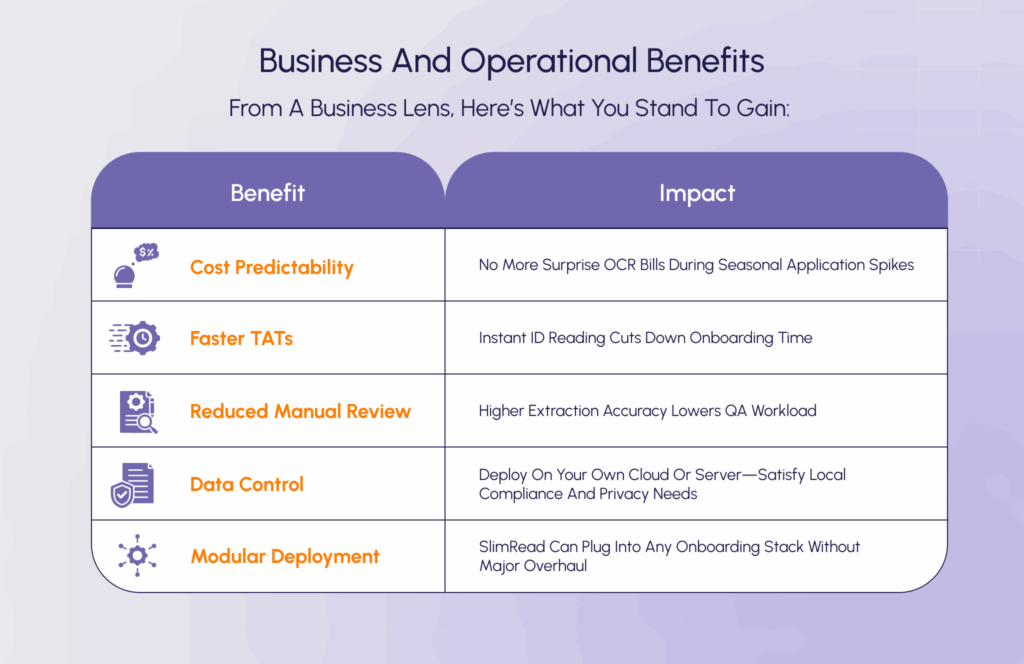

Most onboarding stacks that require stringent KYC rely on OCR for ID processing. While OCR is crucial to a KYC stack, it comes with several operational challenges. Usage-based pricing creates unpredictable costs during peak application periods. Deployment complexity requires ongoing infrastructure management. And accuracy inconsistencies mean manual review teams still handle exceptions. This is where a lean, purpose-built approach makes sense because specialized tools can address these operational pain points with better economics, simpler deployment, and more predictable performance.

The Core Challenge with ID Processing

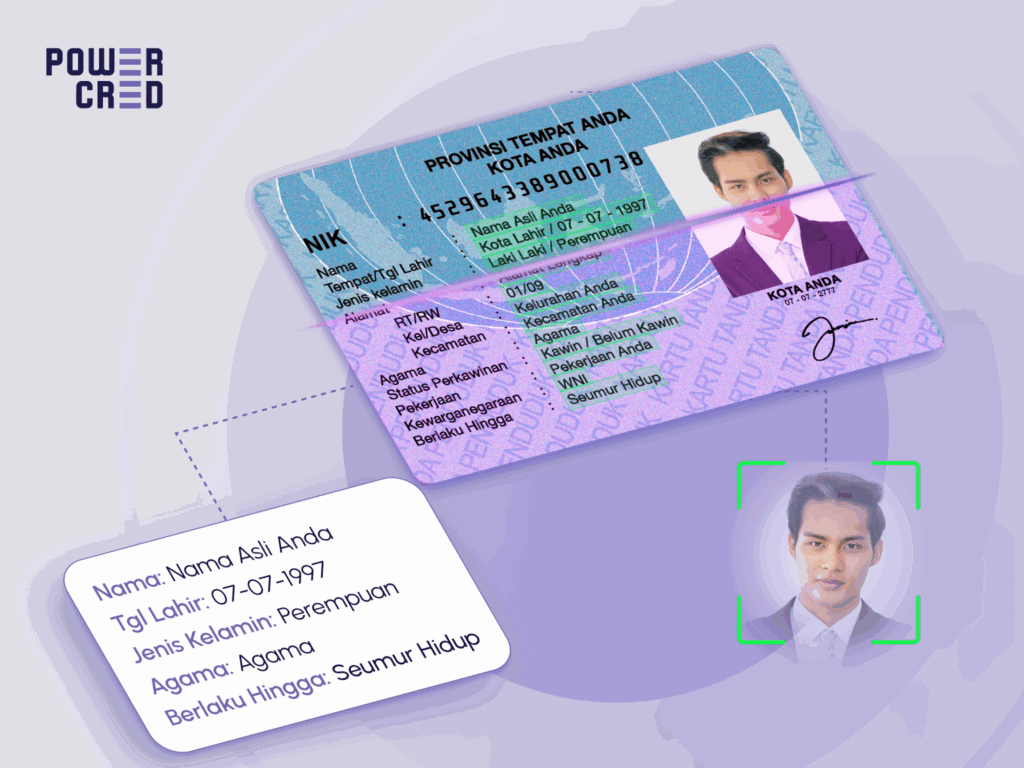

ID card reading is the backbone of most onboarding and KYC workflows. Whether it’s a borrower’s name, date of birth, or ID number, the OCR engine must extract this data accurately, consistently, and without fail—often in real time.

Traditional OCR engines can struggle when:

- The card formats differ by version, format (or country)

- Image quality is suboptimal (blur, glare, etc.)

- The deployment needs to be local (for compliance or latency reasons)

- Usage-based pricing drives up OCR costs during high-volume periods

This is where a purpose-built SLM like PowerCred’s SlimRead makes a difference:

- It’s trained specifically on ID cards

- Runs on lighter infrastructure (no GPU required in the back end)

- It’s able to do everything a traditional OCR does, but quicker and better

- Offers predictable fixed-cost pricing, unlike most OCR APIs

The result? Faster processing, lower costs, and greater control over your onboarding stack!

Why Current OCR Solutions Create These Problems

Most enterprise OCR solutions are powered by Large Language Models (LLMs) designed for complex document understanding and general text processing. While powerful, this creates unnecessary computational overhead when the task is simply extracting standard fields from ID cards. LLMs require heavier infrastructure, consume more resources, and add operational complexity for what is essentially a specialized, repetitive task.

Small Language Models (SLMs) like SlimRead are purpose-built for specific functions—in this case, ID card reading & field extraction. This focused approach eliminates the overhead of general-purpose capabilities you don’t need, resulting in the lighter infrastructure requirements, predictable performance, and operational simplicity that lean solutions offer.

Why This Matters for Lenders, Fintechs, and P2P Platforms

The value of SlimRead is especially relevant across different lending models:

Banks & Digital Lenders need high accuracy for identity verification, without adding latency or operational complexity. SLMs offer performance without dependency on external APIs or expensive infrastructure.

P2P Lending Platforms operate on thinner margins and need scalable solutions that won’t inflate costs with usage. A fixed-cost OCR engine helps stabilize onboarding expenses as user volume grows.

Fintechs (BNPL, Microloans, Salary Advances) need flexible, lean tools that can embed into streamlined tech stacks. An SLM-based OCR engine is easy to deploy and manage without heavy DevOps effort.

Rural or Offline Lenders cannot rely on connectivity while processing applications on ground. Cloud-based OCR isn’t always viable. SlimRead can be deployed on local environments and still deliver high accuracy—ideal for financial inclusion efforts.

Who Is SlimRead For?

SlimRead is designed to serve a wide range of lending teams—regardless of where they are in their digitization journey:

| Lender Type | Digitization Stage | How SlimRead can help optimize onboarding operations |

| Established Banks | Mid-to-advanced digitization | Reduce reliance on heavy OCR tools, improve infra efficiency |

| Multifinancers & Leasing Firms | Mid-stage digitization | Add instant ID verification without reworking existing onboarding workflows |

| Digital-First Lenders & P2P | Highly digitized with lean ops | Scale onboarding without scaling OCR costs |

| Rural or Tier 2–3 Focused Lenders | Early digitization | Lean deployment without the need for complex infrastructure |

Whether you’re digitizing KYC for the first time or looking to optimize an existing stack, SlimRead adapts to your needs without adding overhead. So if you’re a financial services provider who’s focused on optimising your onboarding stack, it’s worth considering a purpose built ID card reader that you can own.

PowerCred’s SlimRead helps lenders simplify ID processing without compromising on accuracy or control.

Curious to know more? Schedule a demo with us!