PowerCred’s Bank Statement Analysis delivers detailed transaction categorizations that transform raw banking data into structured insights for credit decision-making. Our approach focuses on granular classification across three critical areas that directly impact underwriting accuracy and portfolio performance.

Three Core Categorization Areas

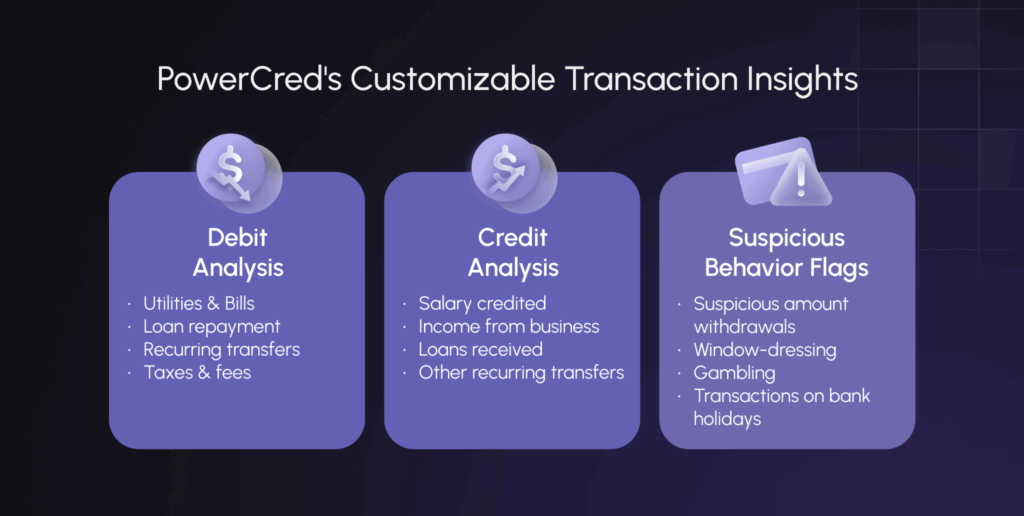

Income Categorization: Precise Revenue Classification

PowerCred’s Bank Statement Analyzer distinguishes between income types for accurate repayment capacity assessment:

- Salary Credits: Regular employment income with employer identification and consistency tracking

- Business Revenue: Self-employment income with seasonality and volatility analysis

- Loan Receipts: Borrowed funds flagged separately from genuine earning capacity

- Recurring Transfers: Investment income, rental payments, and other passive income sources

- Top Income Tracking: Monthly identification of the five largest credit transactions helps assess income concentration risk. Borrowers dependent on one large monthly payment carry different risk profiles than those with diversified income streams.

Expense Categorization: Complete Obligation Mapping

The analysis categorizes expenses into structured buckets that reveal true available cash flow:

- Essential Expenses: Rent, utilities, and basic living costs

- Financial Obligations: Existing EMI payments, credit card dues, and debt service

- Discretionary Spending: Dining, entertainment, and lifestyle purchases

- Business Expenses: Operational costs for self-employed borrowers

- Transfers & Investments: Family support, savings, and investment contributions

- Top Expense Analysis: Tracking the five largest monthly debits reveals major commitments such as substantial family support, business supplier payments, or irregular but significant expenses that impact debt servicing ability.

Fraud Categorization: Comprehensive Risk Detection

Our fraud detection identifies both document-level and transaction-level manipulation:

- Window Dressing: Coordinated deposit-withdrawal patterns designed to inflate apparent income

- Suspicious Cash Activity: Unusual ATM withdrawal patterns that might indicate undisclosed obligations

- Gambling Transactions: Regular payments to gaming platforms or betting services

- Holiday Anomalies: Unusual transactions during bank holidays that suggest automated manipulation

- Circular Transfers: Artificial income inflation through coordinated account movements

Additional Features that Enhance Bank Statement Analysis

Multi-Account Consolidation

When borrowers submit statements from multiple banks, our system provides consolidated analysis across all accounts. This comprehensive analysis can give lenders a more complete financial picture.

Daily Balance Intelligence

We analyze daily end-of-day balances to reveal cash management patterns like:

- Financial Discipline: How borrowers handle money between salary cycles

- Stress Indicators: Frequent near-zero balances despite adequate monthly income

- Reserve Maintenance: Whether borrowers maintain emergency funds (typically IDR 5-10 million buffer)

Multi-Bank Support & Processing

PowerCred’s Bank Statement Analyzer has been trained on 15+ major Southeast Asian banks including OCBC, UOB, Maybank, CIMB, Bank Mandiri, BCA, BNI, BRI, and DBS with unified categorization standards across all institutions.

Relationship Cross-Referencing

Analysis can be customized to cross-reference transaction from other parties by matching data against documents like:

- Family Certificates: To identify and quantify family financial dependencies

- Company Records: To verify business relationships and identify potential conflicts

- Employment Verification: To confirm salary sources match claimed employers

How can PowerCred’s Bank Statement Analysis Help Your Lending Business?

Clients using our bank statement analyzer typically see improvements across four key areas:

- Enhanced Risk Assessment: Comprehensive spending pattern analysis provides deeper insights into borrower financial behavior and creditworthiness

- Fraud Prevention: Automatic flagging of suspicious transaction patterns and manipulated balances helps identify high-risk applications before approval. We’ve helped clients detect 27% more fraud, post implementation

- Operational Efficiency: Automated categorization reduces manual bank statement review time, allowing risk teams to focus on complex cases. You can improve operational efficiencies by up to 70%

- Portfolio Growth: Streamlined analysis enables faster application processing, supporting increased lending capacity

The granular categorization empowers risk teams with specific data points needed for confident lending decisions while maintaining the automation efficiency required for high-volume operations. By transforming complex transaction histories into structured insights, PowerCred can directly support your team’s underwriting criteria and risk assessment frameworks.

Looking to enhance credit assessment with more detailed data insights? Book a demo today!