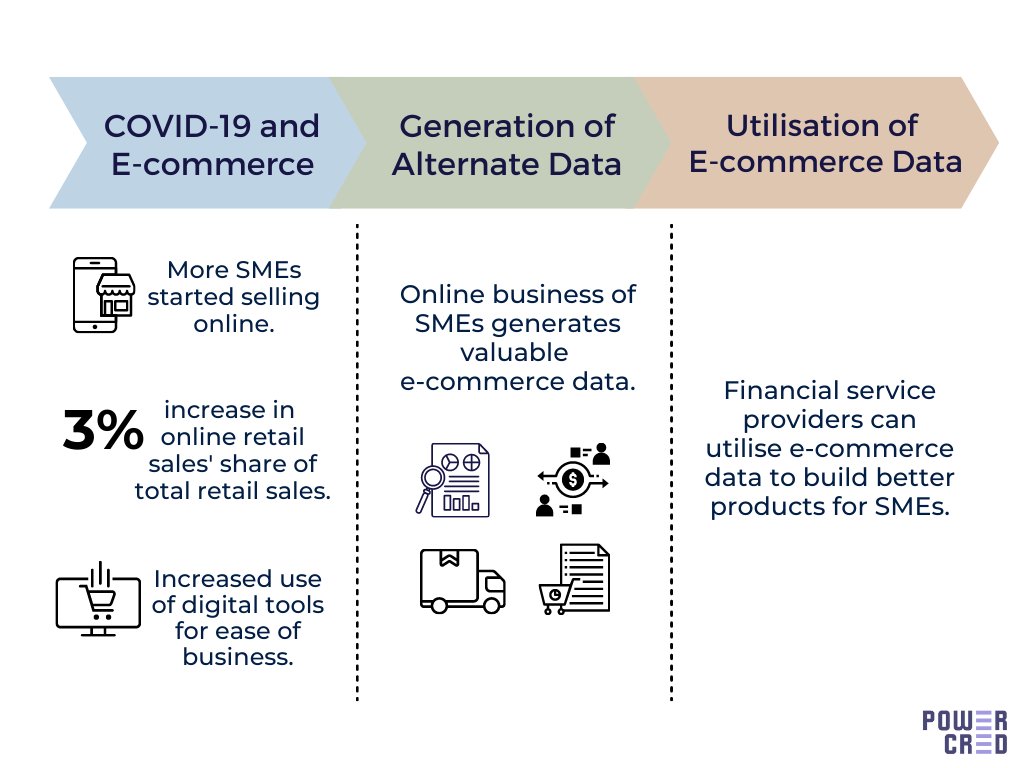

The e-commerce industry witnessed a surge due to more businesses going ‘online’ during COVID-19 lockdowns. As per a report by UNCTAD (United Nations Conference on Trade & Development), the dramatic rise in e-commerce amid movement restrictions induced by COVID-19 increased online retail sales’ share of total retail sales from 16% to 19%. The pandemic pushed businesses to rethink their strategies and transform digitally to leverage online platforms for growing business. Small businesses joined the e-commerce ecosystem by setting up their own online stores and/or selling online on established marketplaces to supplement their offline presence and grow sales. There has been a consequent increase in the adoption of digital tools for ease of business and overall accelerated digitisation of SMEs, giving rise to the generation of a large amount of alternate data.

Such unutilised, high-potential data can be used to get valuable insights into the e-commerce landscape and seller business performance. An analysis of e-commerce business health can help financial service providers build better products for SMEs to grow their online business and enhance their overall customer experience.

Alternate data from E-commerce

An e-commerce business generates a digital footprint substantial enough to produce several alternate data sets that can be leveraged to gain insights into a seller’s business health and performance. Here are a few such e-commerce data sets that can help financial service providers gauge the performance of an online business:

Transaction data

This data set can help summarise the seller’s business health and profitability by analysing transaction data such as payout details, sales data, refunds and credit values.

Order data

The order data for a merchant includes information such as orders received, orders processed and returns; giving an understanding of the order volumes and fulfilment rate of the seller.

Online store data

The online store data of a merchant including store visitors, product views and orders placed can help determine the overall performance of the online storefront and the conversion rate of the store visitors successfully converting into customers for the seller’s business.

Seller performance data

The performance and credibility of a merchant as a seller on an e-commerce platform can be gauged by taking a closer look at the store rating, customer reviews, on-time rating, response rate, response time, late or non-fulfilment of orders and any other violations made by the seller.

Dropshipping data

In the case of a dropshipping business model, the alternate data obtained in connection with the seller’s dropshipping operations can help gain insights into the order volumes, revenue model, cross-border shipments, shipping costs and more. Such insights can be used to judge the scalability and profitability of the seller’s dropshipping business as well as the cross-border demand for the seller’s products.

Conclusion

In order to operate in the fast-growing e-commerce jungle, sellers need to be competitive and consistent in improving their business performance. E-commerce alternate data sets can help financial service providers to

- gain insights into the seller’s business performance

- upgrade existing product and service offerings to help the sellers grow their business

- identify gaps that can be catered to by building new products for small businesses in the e-commerce space.

- provide online businesses with the resources needed to optimise operations and scale their business

The development of new and improved products by financial service providers to suit the changing needs of online sellers would be a growth driver for small businesses as well as a growth opportunity for financial service providers.

To know more about leveraging e-commerce alternate data to build better products for small businesses, get in touch or simply book a demo with us.