The world is going digital at an unprecedented pace. There is no denying that the COVID-19 pandemic has played the role of a catalyst, encouraging digital adoption and transformation for businesses. Whether it is making more informed decisions, achieving scale, streamlining processes, improving operational efficiency or offering better products and services, businesses are embracing digital transformation as the way forward.

Leveraging data is a key aspect of digital transformation but with digitalization, the scope of data is no more limited to its traditional sources. With an overall increase in the digital footprint of individuals and businesses, alternate data from non-traditional sources gives the information advantage to businesses for improved decision-making.

Alternate data from non-traditional sources can include data from e-commerce, social media, social commerce, accounting tools, wallets, geolocations, and more. Such non-conventional data provides unique insights that can help businesses make better decisions in a timely manner.

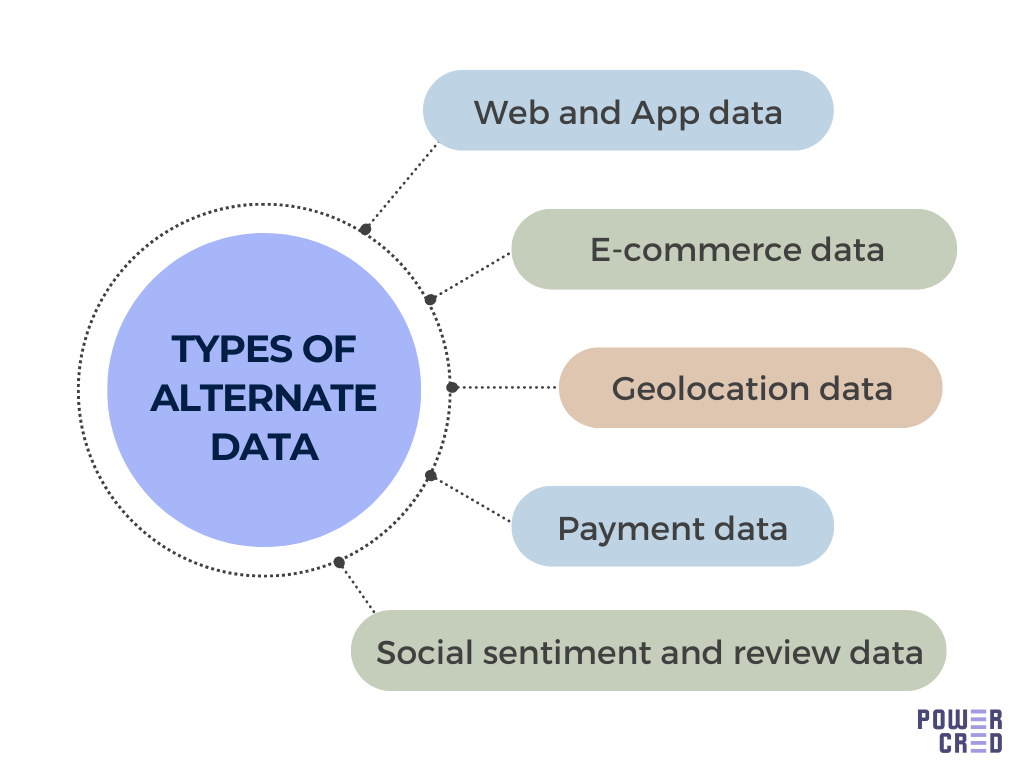

Most common types of Alternate Data

The most common types of alternate data being extensively used in the investment and finance industry include:

- Web and app data

Website and app usage analytics provide extensive data that can help gain insights into market research, website or app performance and the overall online business. Such alternate data may include website traffic, app downloads, user analytics, organic searches, user reviews and more - E-commerce data

E-commerce data is the alternate data sourced from e-commerce platforms, including data from social commerce and F&B. Most commonly used e-commerce data includes order volumes, transaction details and shipping details. Such data can help sellers make informed business decisions and provide insights into an online business’s viability and profitability. - Social Sentiments and Review Data

This data obtained from social media tracks user activity in connection with social media posts, videos and ads of a business to understand the audience sentiment towards the business and its products and services. Audience reactions to social media content and user reviews can help understand social sentiments and current trends in order to make timely changes to the social media strategy. - Geolocation Data

This is the actual geographic location data obtained most commonly from mobile devices and can be used for making location-based decisions. This form of data can help make future investment decisions. - Payment Data

Payment data is the data accessed from payment systems and wallets. Such transactional data is often used to get insight into revenues and payment patterns of small businesses, which can be an indicator of their loan repayment capacity.

Popularity across the Globe

Alternate data may have faced early criticism regarding the value of the information it provides. However, today more people believe that alternate data can indeed provide insights that traditional data cannot. Investment firms were the first ones to embrace this data and make use of the insights gained from it. This paved the way for more firms across the globe to turn to alternate data for valuable insights and better investment and financial decision-making.

In 2017, investment firm JP Morgan estimated asset managers would spend $2-3 million on alternate data, attracting attention to it. The growing demand for alternate data also led to a corresponding increase in the number of data providers with more than 400 companies selling alternate data worldwide. The global alternative data market size was valued at $2.7 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 54.4% from 2022 to 2030. The Banking, Financial Services, and Insurance (BFSI) industry led the market for alternative data and accounted for a revenue share of more than 15.0% in 2021. Some of the highest-growing segments include retail, energy, real estate, construction, transportation and logistics.

Regionally, the Asia Pacific region is expected to emerge as one of the fastest-growing markets because of the increased use of data-driven research by investors. The regional market is anticipated to open significant growth opportunities for companies from emerging economies, such as India, Singapore, Thailand, and China.

Given the acceptance of alternate data as a source of valuable information and insights along with a growing number of use cases emerging for different industries, the popularity of alternate data is on the rise globally.

Conclusion

While alternate data has high potential, it still hasn’t been leveraged to its optimal level. Furthermore, alternate data teamed with artificial intelligence has the potential to transform the way of doing business and benefit the overall financial ecosystem. An increase in the utilisation of alternate data will not just promote financial inclusion but also give actionable insights that can help businesses offer better products to their customers. While ‘data is the new oil’, it will be interesting to see how businesses unlock the power of such valuable data to drive exponential growth and transform the customer experience.

To explore the power and potential of alternate data, get in touch or simply book a demo with us.